The 25-Second Trick For Obtaining Copy Of Bankruptcy Discharge Papers

Table of ContentsSome Known Factual Statements About How Do You Get A Copy Of Your Bankruptcy Discharge Papers Not known Facts About Obtaining Copy Of Bankruptcy Discharge PapersNot known Details About Copy Of Chapter 7 Discharge Papers The Greatest Guide To Obtaining Copy Of Bankruptcy Discharge PapersHow To Get Copy Of Chapter 13 Discharge Papers - TruthsThe 4-Minute Rule for How To Get Copy Of Bankruptcy Discharge Papers

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

This reveals lenders that you're major about making a modification in your financial circumstance as well as increasing your credit scores score in time. Lower degrees of debt can also aid you get a mortgage. The fastest and also easiest means to elevate your credit rating is to make your bank card and also lending repayments on routine each month - copy of chapter 7 discharge papers.

Getting preapproved is essential for a couple reasons: First, a preapproval letter allows you understand which homes remain in your budget plan as well as enables you to narrow your building search. Second, a preapproval informs actual estate agents as well as sellers that you can protect the financing you require to purchase the residence you want to make a deal on.

Chapter 13 Discharge Papers - An Overview

a legal case in which a person that can not pay his/her costs can obtain a fresh financial begin. The right to declare insolvency is offered by federal legislation, as well as all bankruptcy instances are handled in government court. It is wise to have a lawyer. A person that files for bankruptcy is called a (https://62f73bd3c5f37.site123.me/blog/obtaining-copy-of-bankruptcy-discharge-papers-truths).

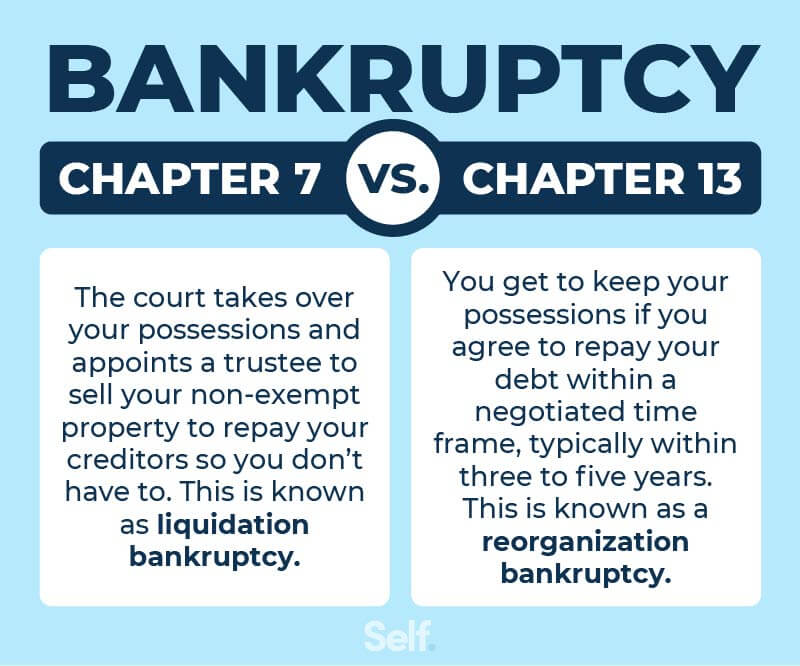

Home which is not excluded is offered and the cash distributed to lenders. In a Chapter 13 instance, you submit a plan demonstrating how you will certainly pay off several of your past-due and present financial debts over a prolonged period, normally three to 5 years. After you finish the strategy, the unpaid equilibrium on certain financial debts may be eliminated.

The amounts of the exemptions are when a wedded pair documents with each other - https://www.ulule.com/b4nkruptcydc/#/projects/followed. Some of your creditors may have an in your residence or individual building. This means that you gave the financial institution a mortgage on your home or place your property up as security for a financial obligation. If you don't make your repayments on the financial obligation, the creditor may have the ability to take and also sell the home or residential or commercial property.

8 Easy Facts About Obtaining Copy Of Bankruptcy Discharge Papers Explained

If you are behind in your payments, the court in a Chapter 13 bankruptcy can offer you time to catch up. For some sorts of property, you can pay the lender the quantity that the building deserves instead than the complete financial debt. If you installed your household goods as security for a finance, you might have the ability to maintain them without making any kind of more payments on the debt.

Yes. The fact that you have actually filed an insolvency can appear on your credit report record for ten years. Given that bankruptcy cleans out your old financial debts, you need to be in a better placement to pay your existing costs, so personal bankruptcy might actually assist you get credit. An utility, such as an electric business, can not refuse or cut off solution since you have declared personal bankruptcy. https://filesharingtalk.com/members/569696-b4nkruptcydc.

Each instance is different. This pamphlet is meant to provide you basic info and also not to give you certain lawful recommendations. Please utilize the details discovered in this sales brochure very carefully since the regulation is frequently altering and also the details may not precisely mirror any type of adjustments in the regulation that happened adhering to the production and also publication of the pamphlet.

A Biased View of How Do You Get A Copy Of Your Bankruptcy Discharge Papers

What is an insolvency discharge, and also just how does it work in Georgia? When a financial obligation is discharged in a Chapter 7 case, a creditor is permanently barred from starting or proceeding collection efforts.

Only financial debts that arose prior to a bankruptcy was filed are dischargeable. If a borrower documents for past due quantities on their electrical expense, only the quantity that was sustained prior to the insolvency declaring can be released.

The Definitive Guide for How Do I Get A Copy Of Bankruptcy Discharge Papers

Yes. The reality that you've filed a personal bankruptcy can show up on your credit scores record for 10 years. Yet considering that insolvency cleans out your old financial debts, you must remain in a better position to pay your present bills, so personal bankruptcy may in fact aid you obtain credit. A public utility, such as an electrical business, can not click for info refuse or cut off solution since you have actually filed for bankruptcy.

When a person declare Chapter 7 bankruptcy, their purpose is to have as a number of their financial debts discharged as feasible (https://www.businessmerits.com/author/b4nkruptcydc/). Yet what is a personal bankruptcy discharge, as well as just how does it operate in Georgia? When a debt is released in a Chapter 7 proceeding, a financial institution is forever disallowed from launching or continuing collection efforts.

How Do I Get A Copy Of Bankruptcy Discharge Papers for Dummies

If a lender does start or proceed collection initiatives on a financial obligation that has actually been released in insolvency, they are in infraction of the united state Bankruptcy Code and also might encounter charges and various other permissions. Instances of activities a financial institution can no more take after a financial obligation has been discharged include the following: Corresponding Calling Taking lawful activity to gather on a financial debt It is very important to note that not all financial debts are dischargeable in a Phase 7 bankruptcy.

Financial obligations also have to be unsafe, implying there is absolutely nothing for the creditor to take if the financial obligation is released. Furthermore, just debts that emerged prior to a bankruptcy was filed are dischargeable. If a borrower documents for past due amounts on their electric costs, only the quantity that was sustained prior to the insolvency declaring can be released.